How do smart contracts interact with wallets and exchanges?

How Do Smart Contracts Interact with Wallets and Exchanges?

Introduction

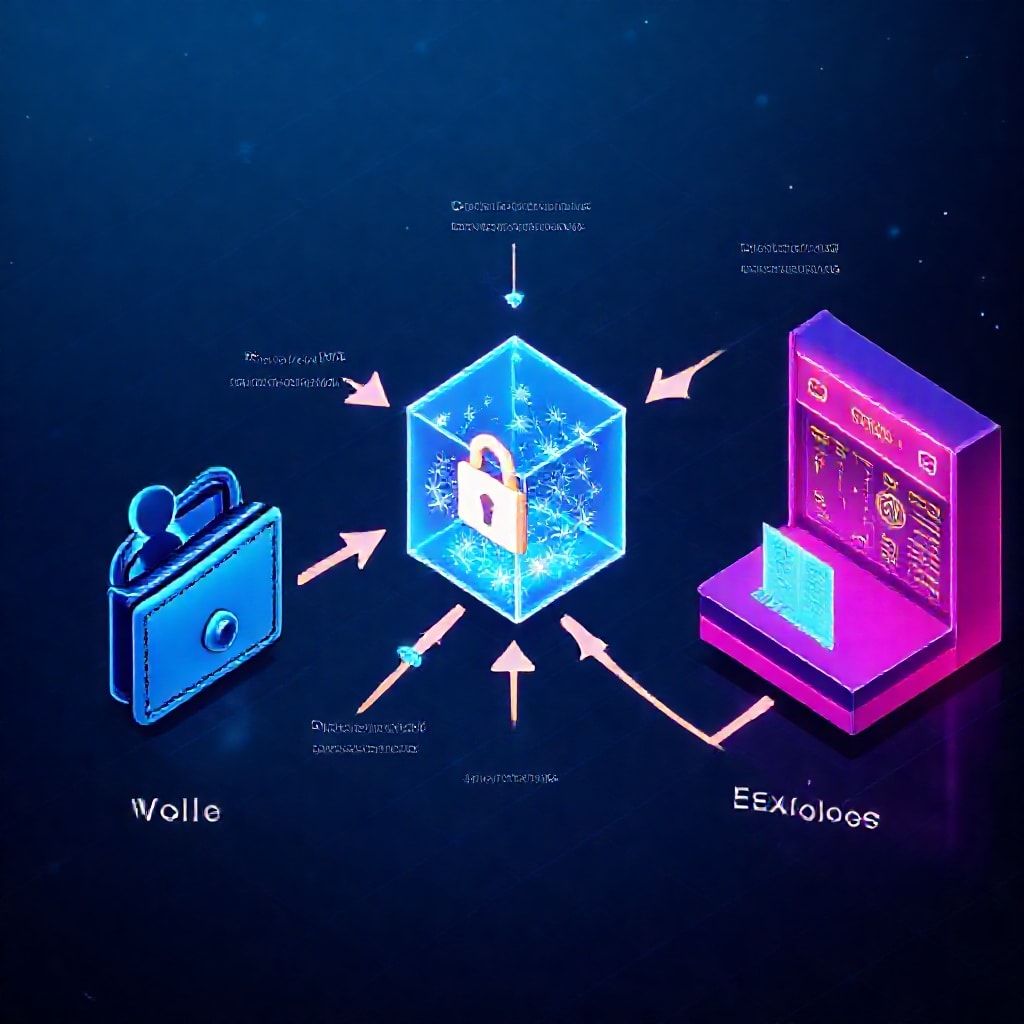

In the world of Web3, your wallet is the gateway and your smart contracts are the engine. When you sign a single transaction from your wallet, you’re scripting a set of rules that govern how an automated you expects the market to move, how funds are moved, and how settlement happens—often without a middleman. That collaboration between wallets, smart contracts, and exchanges—whether centralized, decentralized, or hybrid—powers programmable trading across every major asset class: forex, stocks, crypto, indices, options, and commodities. It’s a frontier where everyday money meets code, offering faster settlement, programmable risk controls, and new ways to access liquidity. But with power comes complexity: security, latency, fees, and the need for trustworthy price data. This article digs into how those pieces fit together, what it means for traders, and where the ecosystem is headed.

How Smart Contracts Work with Wallets

Key Functions

- Signature-based authorization: You own private keys in a wallet. To execute a trade or action, you sign a message that a smart contract verifies. The contract then carries out the logic—whether it’s matching an order, locking collateral, or triggering settlement.

- Automated settlement: Once conditions are met, the contract transfers assets to the counterparty. This eliminates manual reconciliation and reduces counterparty risk, especially in permissionless environments.

- Oracles and data feeds: Smart contracts rely on off-chain data (price feeds, event outcomes) delivered by trusted oracles. Accurate feeds are crucial for things like liquidations, synthetic asset pricing, or price-triggered trades.

- Gas and cost awareness: Each action costs gas. Traders don’t just pay for the contract’s logic; they’re also navigating network congestion and dynamic gas prices, which can affect the feasibility of small or time-sensitive orders.

Practical example

Imagine you want to place a limit order on a DEX powered by a set of smart contracts. You sign a memo from your wallet with the asset, price, and amount. A contract watches the market, and once the price hits your target, it executes the trade, funds are moved from your wallet, and the transaction is settled on-chain. You’ve got programmable control without handing your keys to a centralized party.

Exchanges and On-Chain Interactions

What exchanges do with smart contracts varies by architecture

- Decentralized exchanges (DEXs): These are built around on-chain order books and liquidity pools. Your wallet signs the trade, and the contract executes against pools or matched orders. The entire lifecycle—from order placement to settlement—happens in smart contracts, with live liquidity and transparent rules.

- Centralized exchanges (CEXs) with on-chain components: Some CEXs use on-chain custody for assets and offer on-chain withdrawal/deposit rails. Your wallet interacts with the exchange’s smart contracts for certain operations, but the order book and matching engine may run off-chain. This setup blends familiar UX with some on-chain guarantees.

- Hybrid models: Layer-2 solutions, cross-chain bridges, and synthetic asset platforms extend the idea of on-chain interactions to multi-asset exposure (e.g., tokenized versions of forex or stock indices) while aiming to scale and reduce fees.

Key Points

- Custody and control: With wallets holding private keys, you retain control, but you also shoulder responsibility for security. Smart contracts can automate custody logic (collateralization, margin calls) while keeping you in the loop through transparent state changes.

- Cross-asset plumbing: For forex, stocks, or commodities, many platforms use synthetic assets or cross-asset oracles to represent prices on-chain. Traders can access diversified markets through a unified, programmable interface.

- Latency and UX: On-chain trading adds latency compared to microsecond off-chain matching in large CEXs. Layer-2 scaling and optimized oracles help close the gap, but the trade-off between immediacy and decentralization remains real.

- Fees and slippage: Gas costs, bridge costs, and pool slippage all influence whether an on-chain trade is economical. Traders often optimize by selecting appropriate gas targets, using batch executions, or trading during off-peak times.

Advantage Snapshot: Why this matters across asset classes

- Crypto: On-chain liquidity, programmable leverage, and native settlement. You can build automated strategies that react to price oracles and liquidations in real time.

- Forex and indices: Synthetic assets let you gain exposure to currency pairs or indices without leaving the on-chain world. Oracles provide price input; risk controls can be coded into the contract.

- Stocks and commodities: Tokenized or synthesized exposures enable diversified portfolios with programmable risk management. Regulatory and custody considerations are evolving, so stay informed about the platforms you use.

- Options and derivatives: Smart contracts can model payoff structures, manage collateral, and automate exercise or settlement, enabling novel risk management and strategy automation.

Reliability and Security Considerations

- Audits and governance: Rely on contracts audited by reputable firms, and look for clear upgrade paths with multi-signature governance or timelocks.

- Front-running and MEV: On-chain traders contend with front-running and Miner Extractable Value (MEV). Mitigation techniques include private transaction pools, fair sequencing, and robust oracle designs.

- Insurance and risk controls: Some ecosystems offer smart contract insurance or viewer-friendly risk dashboards. Pair with prudent risk management, including position sizing and diversification.

- Test and verification: Use testnets, paper trades, and dry runs before live deployment. Layered defense—wallet security, contract security, and operational controls—reduces risk.

Leveraging and Risk Management: A Trader’s Playbook

- Leverage within DeFi: Margin and lending protocols (e.g., enabling synthetic leverage via collateralized positions) can magnify exposure, but liquidation risk rises with price swings. Set conservative collateral factors and use automated liquidation protection where available.

- Stop-loss and take-profit on-chain: Some contracts support conditional orders (e.g., if price hits X, close position). Others require bespoke setups or external automation. Validate behavior in simulation to avoid surprises.

- Diversification across assets: Use programmable exposure to crypto, synthetic forex, and tokenized indices to spread market risk rather than concentrating on one asset class.

- Charting and on-chain analytics: Leverage on-chain data platforms to track contract state, liquidity depth, and liquidity provider behavior. Combine on-chain signals with traditional TA for a more complete view.

- Practical workflow: Start with a familiar asset (e.g., a stablecoin-denominated synthetic asset for exposure), test your wallet and contract interactions on a testnet, then scale to live trading with clear limits and monitoring.

Future Trends: Smart Contracts, AI, and Web3 Trading

- AI-driven trading on-chain: Autonomous agents and AI-assisted strategies could execute, optimize, and adapt in real time, guided by on-chain signals and off-chain computation results.

- On-chain AI collaboration: Trusted execution environments and privacy-preserving computation may let AI models run securely off-chain while delivering outcomes back to smart contracts for execution.

- Cross-chain liquidity and interoperability: Multichain wallets and interoperable bridges will enable seamless exposure to assets across ecosystems, reducing friction between forex-like markets, stocks, and crypto.

- Regulation, compliance, and transparency: The balance between openness and regulatory guardrails will shape how easily institutions adopt on-chain trading, with standardized KYC/AML practices and auditable on-chain provenance.

Promotional slogans and guiding statements

- Trade smarter with programmable certainty—smart contracts turning your wallet into a precision engine.

- From cash markets to tokenized assets, automated settlement without sacrificing control.

- On-chain liquidity, off-chain insight—unified access to multi-asset trading with safety rails.

- The future of trading is composable: build, test, deploy, and iterate with confidence.

Conclusion: Where the web3 finance picture is headed

Smart contracts, wallets, and exchanges are converging into a programmable financial ecosystem that supports broad asset exposure with automated risk controls and transparent settlement. The benefits—speed, automation, and diversified access—sit alongside genuine challenges: security, latency, regulatory clarity, and the complexity of multi-asset on-chain validation. Traders who pair robust security practices with tested workflows, reliable data feeds, and prudent risk management will be well positioned as DeFi matures. The road ahead includes AI-assisted decision-making, scalable Layer-2 and cross-chain infrastructure, and smarter, smarter-smart contracts that can adapt to a rapidly evolving financial landscape. And as you explore, remember this: your wallet is your control center, smart contracts are your programmable engine, and exchanges—whether on-chain or hybrid—are your liquidity channels.

If you’re curious to explore hands-on, start small, map your trades to programmable rules, and watch how the on-chain world responds to your strategy. The intersection of wallets, smart contracts, and exchanges is not just a tech story—it’s a practical path to rethinking how you access, manage, and grow value across markets.

YOU MAY ALSO LIKE